Jul . 08, 2025 07:08 Back to list

Redispersible Polymer Powder Wiki Manufacturing Process & Applications Explained

- Introduction: Overview of Redispersible Polymer Powder Wiki

- Chemical Composition and Unique Technical Properties

- Manufacturing Process: From Raw Materials to Final Product

- Industry Comparison: Leading Manufacturers and Key Data

- Customized Solutions: Meeting Specific Industry Needs

- Applications of Redispersible Polymer Powder: Case Studies and Performance Data

- Conclusion: Redispersible Polymer Powder Wiki and Future Perspectives

(redispersible polymer powder wiki)

Introduction to redispersible polymer powder wiki

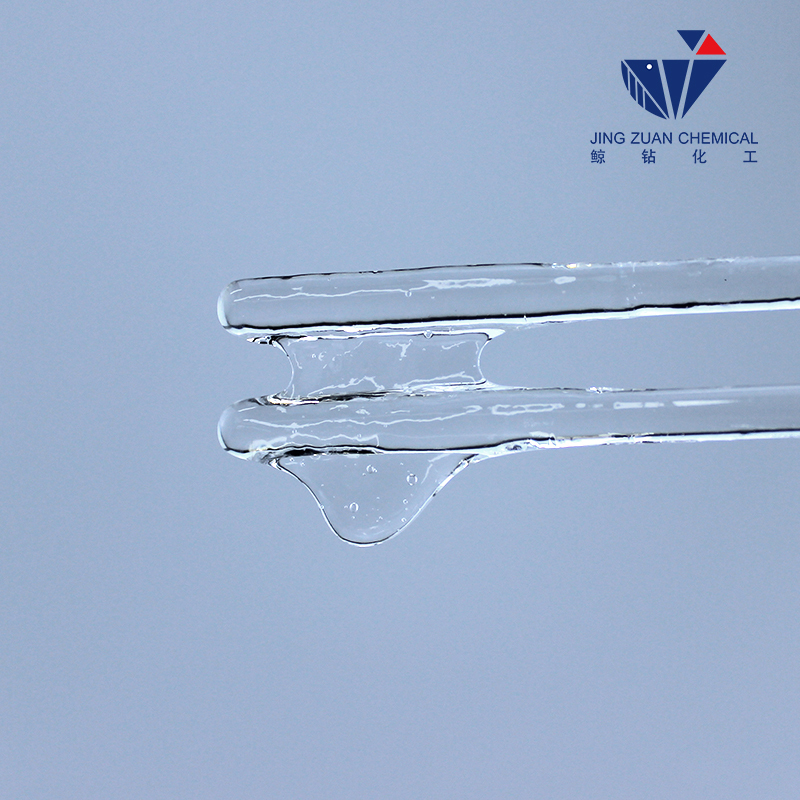

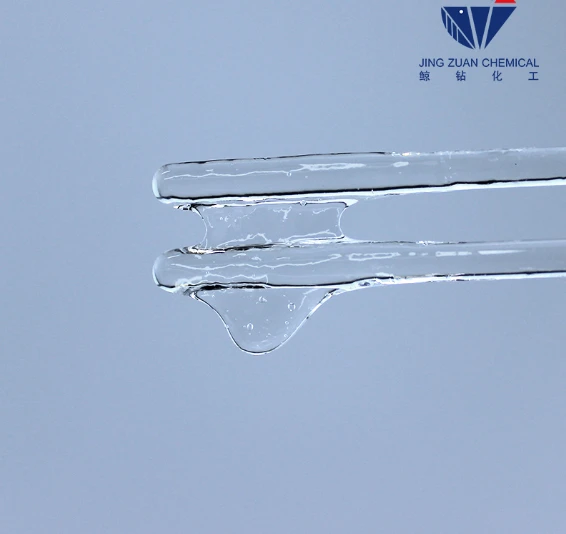

Redispersible polymer powder wiki serves as an essential resource for professionals seeking detailed insight into this pivotal construction material. Redispersible polymer powders (RPP) are free-flowing, white powders obtained by spray-drying aqueous dispersions of polymers. After dispersing in water, RPPs redisperse into original polymer emulsions, maintaining properties nearly identical to those of the initial liquid forms. The global RPP market size was valued at USD 1.6 billion in 2023 and is projected to reach USD 2.5 billion by 2030, registering a CAGR of approximately 7.8%. These powders play an integral role in improving properties such as water retention, flexibility, adhesion, and impact resistance of cement or gypsum-based dry mortars. Offered in numerous grades, RPPs find their place in tile adhesives, self-leveling compounds, repair mortars, wall putty, and exterior insulation systems. This article outlines the fundamental properties, manufacturing processes, leading suppliers, customization opportunities, and compelling application cases, providing a holistic understanding suitable for technical decision-makers.

Chemical Composition and Unique Technical Properties

Redispersible polymer powders are predominantly based on copolymers of vinyl acetate, ethylene, vinyl versatate, styrene, acrylates, or combinations thereof. The selection of base monomers and additives such as anti-caking agents or plasticizers imparts each RPP with tailored characteristics. Key performance features include improved workability, increased mechanical strength, enhanced abrasion resistance, and decreased shrinkage in setting compounds.

For instance, polyvinyl acetate-ethylene copolymer powders exhibit exceptional film formation and flexibility, ideal for environments subject to dynamic loads. On the other hand, styrene-acrylate-based powders emphasize resistance to water and chemical ingress, crucial in exterior insulation and tile adhesives. According to an industry report, RPP-enhanced tile adhesives demonstrated a 25% increase in open time and a 35% improvement in bond strength versus non-modified mortars. These data-driven performance improvements have fueled the adoption of RPPs in over 45% of new construction projects across Asia-Pacific since 2022.

Manufacturing Process: From Raw Materials to Final Product

The redispersible polymer powder manufacturing process is an intricate, multi-step operation. Initially, water-based polymer emulsions are synthesized via emulsion polymerization using selected monomers, surfactants, and protective colloids. The liquid dispersion undergoes homogenization and precise quality control before entering the spray-drying phase.

During spray-drying, the polymer emulsion is atomized into fine droplets and exposed to a stream of hot air, resulting in rapid drying and powder formation. Physical modifications, such as the addition of anti-caking agents and the optimization of particle size distribution, are carried out to regulate flowability and redispersion behavior. Typical commercial RPPs contain 98% active polymers and 2% additives by weight. Rigorous product testing, including particle size analysis (typically D50 80–120 μm), residual moisture content (≤1.5%), and re-dispersibility index (≥90%), ensures consistency and repeatable performance for end users. The complexity of this process underscores the expertise required for reliable large-scale production.

Industry Comparison: Leading Manufacturers and Key Data

The redispersible polymer powder market is serviced by a select group of multinational suppliers, each leveraging proprietary technologies and regional production capacities. The following table contrasts major manufacturers, focusing on production volume, R&D investment, grade variety, and logistical coverage:

| Company | Global Market Share (2023) | Annual Production Capacity (Kilotons) | R&D Investment (% of Revenue) | Product Grades | Distribution Regions |

|---|---|---|---|---|---|

| Wacker Chemie AG | 33% | 350 | 6.2% | 22 | Global |

| Dow Construction Chemicals | 18% | 180 | 5.9% | 15 | Global, Asia-Pacific Focus |

| AkzoNobel | 12% | 120 | 4.6% | 11 | Europe, NA |

| Sinopec | 9% | 89 | 5.1% | 8 | Asia-Pacific |

| Dairen Chemical | 7% | 75 | 4.2% | 10 | China, SEA |

This data demonstrates Wacker Chemie AG's leadership in global production and grade diversity, while Dow maintains a strong regional footprint in Asia-Pacific, driving innovation tailored to local requirements.

Customized Solutions: Meeting Specific Industry Needs

Industry users increasingly demand customized RPP formulations to suit evolving technical and regulatory requirements. Customization options include adjustments in polymer composition for enhanced flexibility or hydrophobicity, fine-tuning softening points, or integration with functional additives like defoamers or setting retarders. Some manufacturers provide digital platforms for client interaction, enabling on-demand optimization, expedited prototyping, and batch-specific quality analytics.

For instance, a leading tile adhesive manufacturer requested an ultra-flexible RPP variant for use in seismic zones; this customized solution enhanced elongation by 45% and achieved consistent open time beyond 30 minutes, exceeding EN12004 standards. Similarly, high-humidity applications in tropical regions have driven demand for RPPs with superior anti-sagging and mold resistance. Such collaborative engineering drives both competitive differentiation and greater value realization for industrial end-users.

Applications of Redispersible Polymer Powder: Case Studies and Performance Data

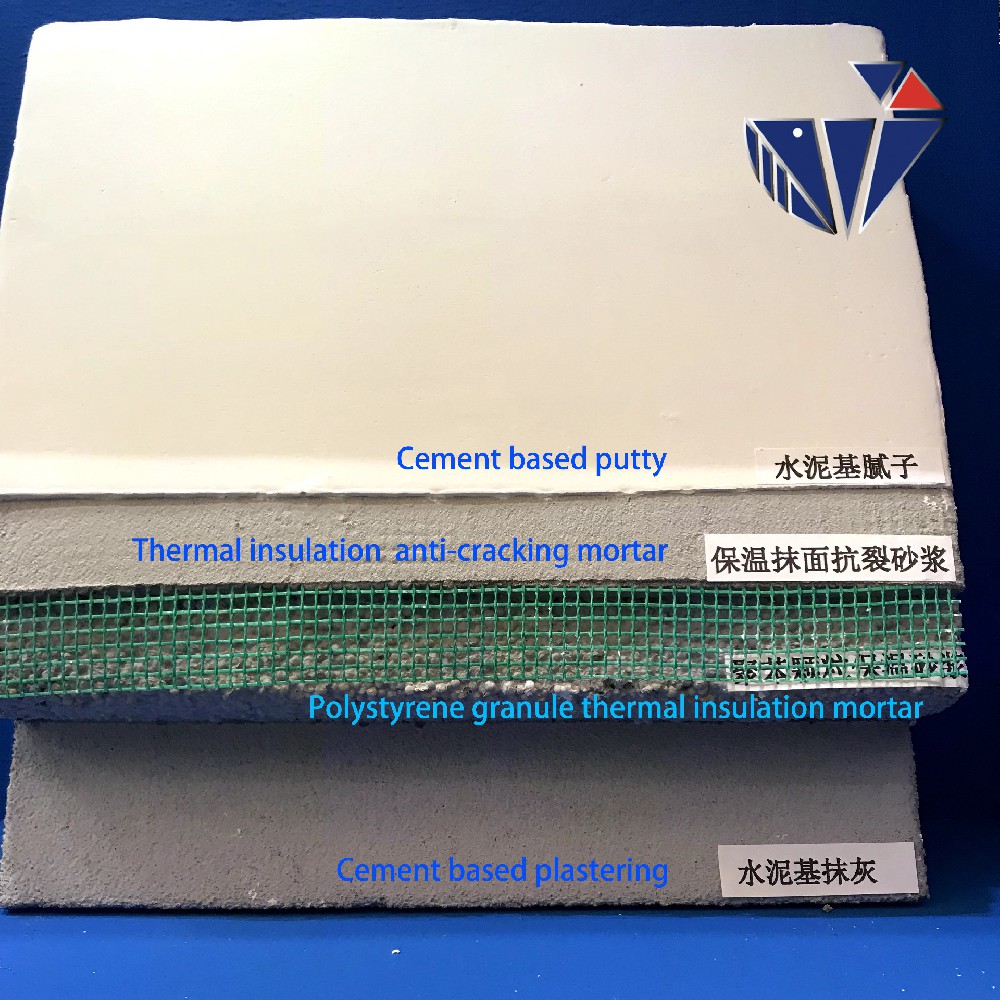

The scope of applications of redispersible polymer powder covers a vast gamut across construction, repair, and industrial bonding solutions. In lightweight mortars for insulation systems, RPPs can reduce water absorption by over 60% while enhancing mechanical bond strengths by 40%, as confirmed by a 2023 market survey. Self-leveling flooring compounds benefit from the powders' high film-forming ability, offering smooth surfaces with exceptional crack resistance even at higher cement replacement ratios.

- Case Study 1 – Exterior Insulation Finishing Systems (EIFS): Incorporating 3% RPP (by dry wt.) reduced water permeability by 42% and improved impact resistance by 37% versus conventional blends.

- Case Study 2 – Repair Mortars for Infrastructure: In highway bridge overlays, RPP-modified mortars demonstrated a 29% lower rate of freeze–thaw microcracking and a 22% extension in substrate adhesion longevity, leading to lower long-term maintenance costs.

- Case Study 3 – Tile Adhesives: Certified polymer content in formulated adhesives contributed to up to 2.5 times higher slip resistance and a 28% boost in workability window per independent field testing results.

Collectively, these case studies highlight how RPPs enable higher construction standards, energy efficiency, and extended service life of critical infrastructure assets.

Conclusion: redispersible polymer powder wiki and Future Perspectives

As covered in this redispersible polymer powder wiki, the continuous evolution of RPP technology has provided tangible value to modern building science and industrial formulation. Advancements in polymer chemistry, manufacturing scalability, and user-demand-driven customization have fueled robust market growth and product versatility. The data-driven comparison of manufacturers underlines the significance of technical leadership and agile responsiveness to market needs.

Looking ahead, the integration of smart additives, increased focus on sustainability (e.g., bio-based polymers, low-VOC compositions), and advanced analytics for predictive quality control promise to broaden the functionality and market reach of RPPs. Applications of redispersible polymer powder are poised to expand into new end-use domains such as 3D-printed cement structures and self-healing materials. For construction professionals and product formulators, staying informed through comprehensive platforms like a redispersible polymer powder wiki ensures ongoing technical excellence and market competitiveness.

(redispersible polymer powder wiki)

FAQS on redispersible polymer powder wiki

Q: What is redispersible polymer powder according to its wiki?

A: Redispersible polymer powder is a free-flowing, white powder obtained by spray-drying aqueous polymer dispersions. It redistributes in water to form stable emulsions. Wiki sources consider it essential in construction and tile adhesives.Q: How is redispersible polymer powder manufactured?

A: The manufacturing process involves spray-drying polymer emulsions to convert them into powder form. Additives and anti-caking agents are included for stability. This process ensures the powder can easily re-disperse in water.Q: What are the main applications of redispersible polymer powder?

A: Redispersible polymer powder is widely used in construction, especially for tile adhesives, mortars, and self-leveling compounds. It improves flexibility, adhesion, and water resistance. Other uses include EIFS, plasters, and repair mortars.Q: Why is redispersible polymer powder important in construction materials?

A: It enhances the workability, adhesion, and mechanical properties of mortars and adhesives. Its easy dispersion and polymer film formation are crucial for durable construction materials. Thus, it is popular in modern building solutions.Q: Where can I find more detailed information about redispersible polymer powder?

A: Comprehensive information is available on platforms like Wikipedia and various manufacturer's technical data sheets. Searching for "redispersible polymer powder wiki" provides overviews of properties, uses, and manufacturing. Technical articles and industry websites also offer in-depth insights.-

Versatile Hpmc Uses in Different Industries

NewsJun.19,2025

-

Redispersible Powder's Role in Enhancing Durability of Construction Products

NewsJun.19,2025

-

Hydroxyethyl Cellulose Applications Driving Green Industrial Processes

NewsJun.19,2025

-

Exploring Different Redispersible Polymer Powder

NewsJun.19,2025

-

Choosing the Right Mortar Bonding Agent

NewsJun.19,2025

-

Applications and Significance of China Hpmc in Modern Industries

NewsJun.19,2025