Dec . 12, 2024 15:02 Back to list

hpmc stock

Analyzing HPMC Stock Trends and Future Outlook

Hydroxypropyl Methylcellulose (HPMC) is a cellulose ether that has become increasingly significant across various industries, particularly in pharmaceuticals, construction, and food. The demand for HPMC has been on the rise due to its versatile applications, leading to a noteworthy interest in HPMC stock as a potential investment opportunity. This article delves into the current trends in HPMC stock, factors influencing its performance, and future outlook.

Current Market Trends

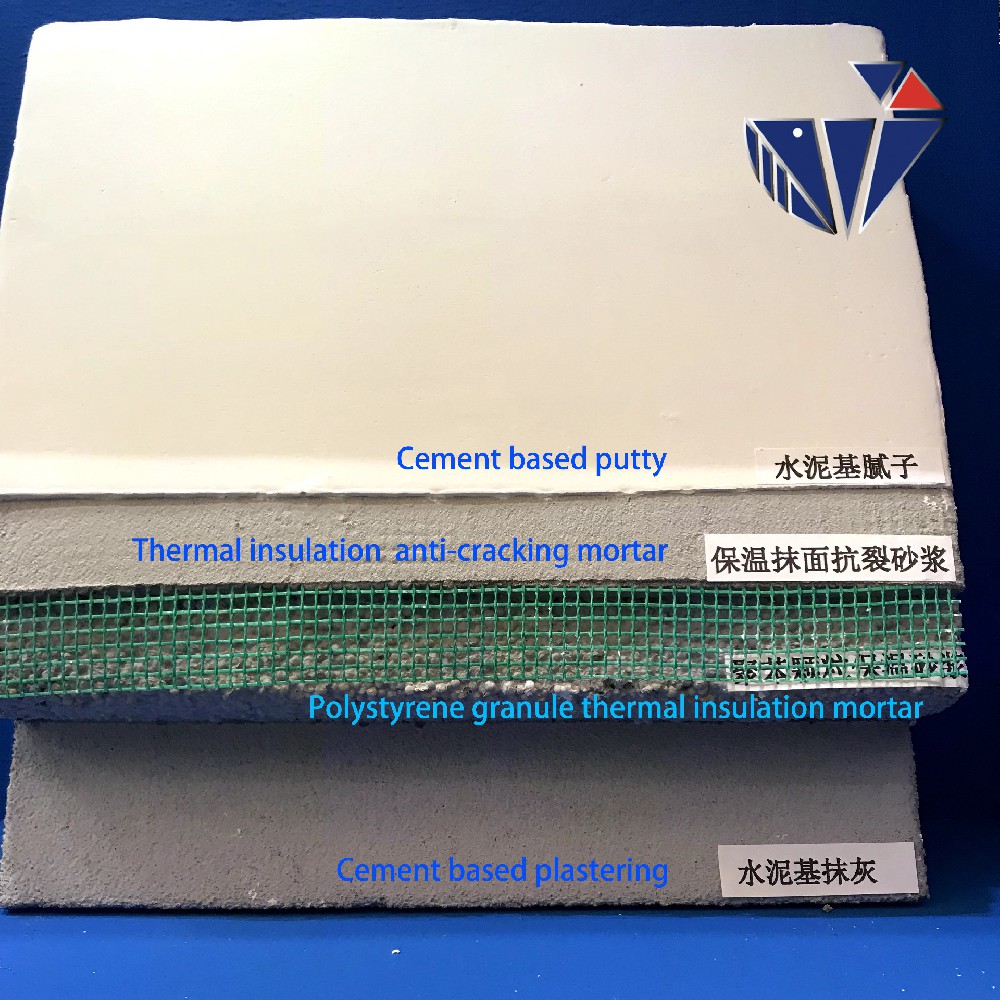

The global HPMC market has been experiencing steady growth, fueled by the expanding pharmaceutical and construction sectors. In pharmaceuticals, HPMC is prized for its binding and coating capabilities, making it vital in the production of tablets and other dosage forms. The construction sector utilizes HPMC as a thickener and water-retention agent in products like mortars and adhesives, enhancing their performance. As construction activities ramp up worldwide, particularly in emerging markets, the demand for HPMC continues to rise.

From an investment perspective, HPMC stock has shown resilience, even amidst global economic challenges. Companies involved in the production and distribution of HPMC have leveraged their position in the market, demonstrating robust financials that attract investors. An analysis of recent stock performance indicates a steady upward trend, suggesting that investors are optimistic about the long-term potential of HPMC-related ventures.

Key Factors Influencing HPMC Stock Performance

Several factors play a crucial role in influencing HPMC stock performance. Firstly, advancements in technology and increasing research activities contribute significantly to market growth. As companies continue to innovate and improve production processes, this can lead to reduced costs and increased profitability, enhancing stock value.

hpmc stock

Secondly, regulatory frameworks impact HPMC usage and production, particularly in the pharmaceutical sector. Stringent regulations ensure that HPMC products meet safety and efficacy standards, which can stabilize market demand. Companies adept at navigating these regulations often gain a competitive advantage, positively affecting their stock performance.

Lastly, global economic conditions are paramount in determining HPMC stock success. Economic downturns can slow construction activities and consequently affect the demand for HPMC in the construction sector. However, the ongoing recovery from the pandemic has spurred infrastructure projects and increased investments in healthcare, projecting a more favorable environment for HPMC stock.

Future Outlook

Looking ahead, the future of HPMC stock appears promising. The growing trend towards sustainability and the increasing use of eco-friendly materials in construction and other sectors provide HPMC with a unique advantage. As industries seek greener alternatives, the properties of HPMC, such as biodegradability and low environmental impact, position it as a material of choice.

Additionally, the healthcare sector's continued expansion, driven by an aging population and increasing health awareness, bodes well for HPMC's demand in pharmaceuticals. Companies that focus on diversifying their product offerings and entering new markets are likely to accelerate their growth, subsequently boosting their stock appeal.

In conclusion, HPMC stock represents a compelling investment opportunity, underpinned by robust market demand, technological advancements, and positive economic trends. As companies within this sector adapt to changing market dynamics and strive for innovation, investors would do well to keep a close eye on HPMC stock. While risks always accompany any investment, the long-term outlook for HPMC stock remains favorable, making it a worthy consideration for those looking to enrich their portfolios.

-

Versatile Hpmc Uses in Different Industries

NewsJun.19,2025

-

Redispersible Powder's Role in Enhancing Durability of Construction Products

NewsJun.19,2025

-

Hydroxyethyl Cellulose Applications Driving Green Industrial Processes

NewsJun.19,2025

-

Exploring Different Redispersible Polymer Powder

NewsJun.19,2025

-

Choosing the Right Mortar Bonding Agent

NewsJun.19,2025

-

Applications and Significance of China Hpmc in Modern Industries

NewsJun.19,2025