Aug . 14, 2024 12:06 Back to list

Exploring Investment Opportunities and Market Trends for HPMC Stock Performance and Analysis

A Comprehensive Overview of HPMC Stock Trends, Analysis, and Future Prospects

Hydroxypropyl methylcellulose (HPMC) is a versatile and widely used cellulose ether in various industries, including pharmaceuticals, food, cosmetics, and construction. The significance of HPMC in these sectors has prompted investors to pay close attention to the stock performance of companies engaged in the production and distribution of HPMC. This article aims to provide a detailed analysis of HPMC stock, focusing on market trends, company performance, and future prospects.

Market Trends

The global HPMC market has been experiencing substantial growth, driven by increasing demand in the pharmaceutical sector, particularly in the formulation of drug delivery systems. HPMC is favored in the industry for its excellent rheological properties and ability to act as a binder, film-former, and thickener. As the pharmaceutical sector expands, particularly with the rise of generics and biosimilars, companies producing HPMC are likely to see a corresponding increase in stock value.

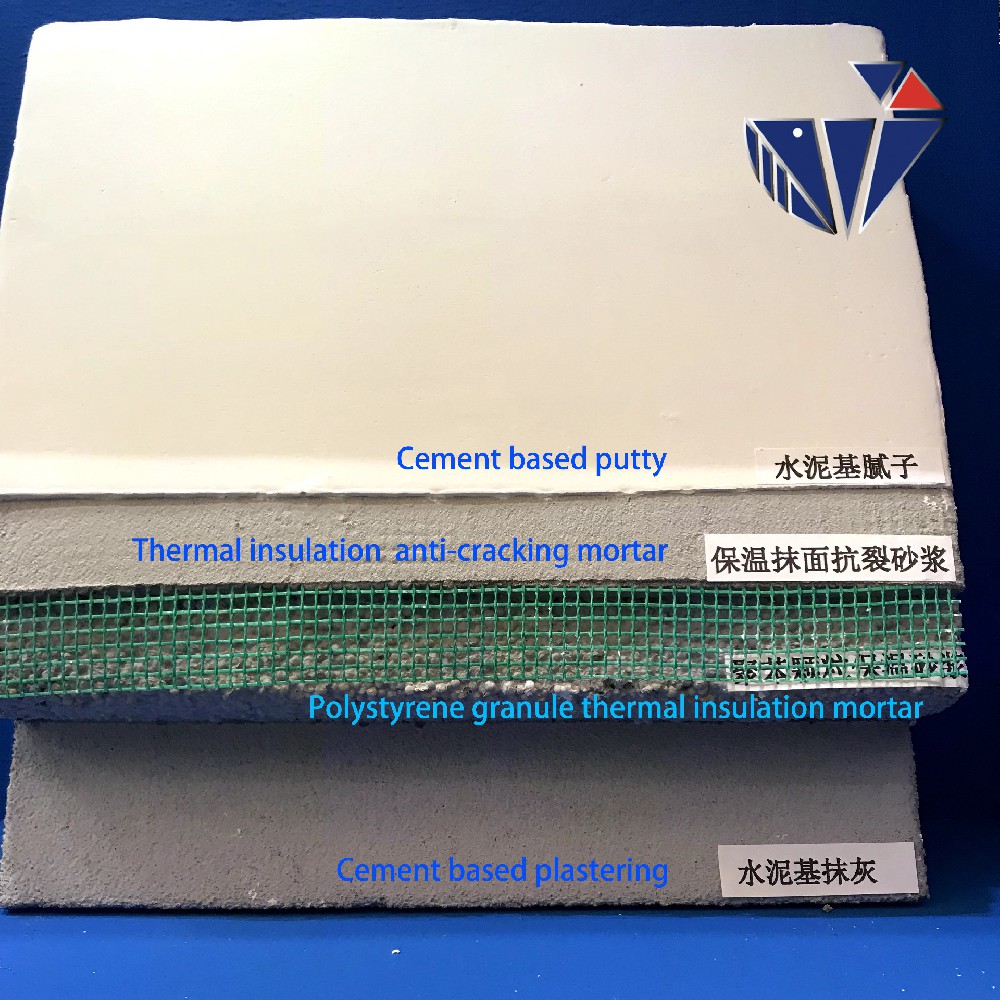

Additionally, the food industry’s growing trend towards clean-label products has fueled demand for HPMC as a thickening agent and stabilizer. Health-conscious consumers are driving manufacturers to seek natural and safe additives, further enhancing HPMC's appeal. Similarly, increased construction activity worldwide is contributing to the demand for HPMC in cement and mortars. These trends indicate a positive outlook for HPMC stock in the coming years.

Company Performance

Several companies dominate the HPMC market, including Dow Chemical, Ashland Global Holdings, and Shin-Etsu Chemical. These firms have established robust market positions, contributing to their stock resilience. For instance, companies like Ashland have consistently reported strong revenue growth attributed to their HPMC products, which has positively influenced their stock prices.

Investors should also consider companies that cater to niche markets within the HPMC sphere. For example, firms focusing on sustainable and bio-based HPMC are slowly gaining traction. This innovative approach resonates well with environmentally conscious consumers and provides these companies with a competitive edge.

hpmc stock

Financial Analysis

When examining HPMC stocks, key financial metrics such as earnings per share (EPS), price-to-earnings (P/E) ratios, and revenue growth are critical. Historically, HPMC manufacturers have shown resilient financial performance due, in part, to the stable demand for their products. Investors should monitor quarterly earnings reports closely, looking for consistent revenue streams and positive guidance from management regarding future growth.

Additionally, the global supply chain dynamics and raw material costs can significantly impact profitability. Investors should stay informed about fluctuations in cellulose prices and their potential effects on margins for HPMC manufacturers. Strategic initiatives, such as vertical integration and cost-cutting measures, can further influence stock performance.

Future Prospects

Looking ahead, the future of HPMC stock appears promising. The ongoing trends in e-commerce and personalized medicine are set to propel growth in the HPMC market. As pharmaceutical companies seek more efficient drug delivery methods and manufacturers respond to consumer demand for natural additives, HPMC's utility will continue to expand.

Moreover, continued investments in research and development will likely lead to the introduction of innovative HPMC variants, further enhancing market competitiveness. With increasing global awareness of environmental sustainability, companies adopting green practices in HPMC production may also enhance their attractiveness to investors.

In conclusion, HPMC stock represents a compelling investment opportunity grounded in solid market fundamentals and growth prospects. As industries increasingly rely on HPMC's properties for a wide array of applications, investors would do well to keep an eye on this evolving market. By staying informed and analyzing trends, one can make educated investment decisions in HPMC stock and capitalize on its potential for future gains.

-

Why HPMC is a Key Additive in Wall Putty Formulations

NewsAug.05,2025

-

Redispersible Powder in Decorative Renders: Function Meets Finish

NewsAug.05,2025

-

Redispersible Powder for Interior Wall Putty: Smooth Results Every Time

NewsAug.05,2025

-

HPMC’s Water Retention Capacity in Dry Mortar Applications

NewsAug.05,2025

-

HPMC Factory Contributions to Liquid Detergents

NewsAug.05,2025

-

How HPMC Factory Products Change Detergent Textures

NewsAug.05,2025