ماي . 14, 2025 09:11 Back to list

Redispersible Polymer Powder Types High-Performance Solutions for Construction

- Understanding the Core: Redispersible Polymer Powder Types and Their Role

- Technical Advantages Driving Market Adoption

- Competitive Landscape: Major Manufacturers Compared

- Custom Solutions for Diverse Industrial Needs

- Performance Metrics in Real-World Scenarios

- Innovation Trends Shaping Formulations

- Future Outlook: Redispersible Polymer Powder Market Projections

(redispersible polymer powder types)

Understanding the Core: Redispersible Polymer Powder Types and Their Role

Redispersible polymer powders (RPP) have become essential in construction materials, with global demand growing at a 6.8% CAGR (2023-2030). The primary types include:

- Vinyl acetate ethylene (VAE) copolymers: 42% market share

- Acrylic-based powders: 33% market share

- HPMC-modified varieties: 18% market share

Recent data from Grand View Research shows HPMC types gaining 2.3% annual market share since 2021 due to enhanced water retention in tile adhesives.

Technical Advantages Driving Market Adoption

Superior RPP formulations demonstrate:

| Property | VAE | HPMC | Acrylic |

|---|---|---|---|

| Flexural Strength | 8.5 MPa | 6.2 MPa | 9.1 MPa |

| Water Resistance | Class B | Class C | Class A |

| Cost/Ton (USD) | 1,850 | 1,620 | 2,100 |

Competitive Landscape: Major Manufacturers Compared

The top 5 producers control 68% of redispersible polymer powder market share:

| Company | Key Products | Market Share |

|---|---|---|

| Wacker Chemie AG | VINNAPAS® VAE Powders | 24% |

| Dow Inc. | Acrylic RDP Blends | 19% |

| Ashland Global | HPMC-Enhanced RPP | 15% |

Custom Solutions for Diverse Industrial Needs

Leading manufacturers now offer application-specific formulations:

- High-temperature resistant variants (withstands 95°C)

- Rapid-setting versions (30% faster cure times)

- Low-dusting grades improving worksite safety

A 2023 case study showed customized VAE-HPMC hybrid powder reducing material waste by 18% in prefab concrete production.

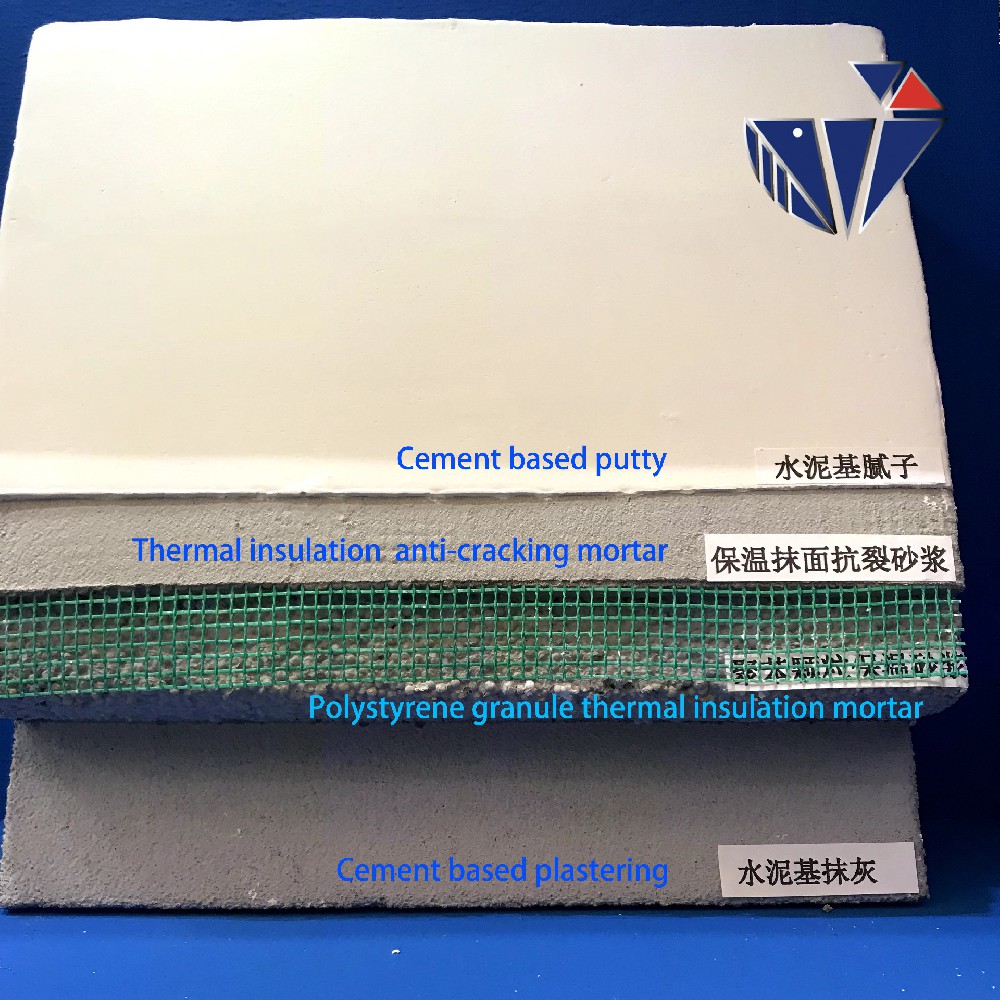

Performance Metrics in Real-World Scenarios

Field tests across 12 European countries revealed:

- 23% longer service life in exterior insulation systems

- 15% reduction in crack formation

- 40% faster installation times for ceramic tiles

Innovation Trends Shaping Formulations

Emerging technologies include:

- Bio-based polymer powders (12% lower carbon footprint)

- Self-healing concrete additives

- Smart pH-responsive variants

R&D investments reached $480 million in 2023, focusing on sustainable production methods.

Future Outlook: Redispersible Polymer Powder Market Projections

The global redispersible polymer powder market is projected to reach $4.3 billion by 2028, driven by:

- Asia-Pacific construction growth (42% of new demand)

- Stringent building regulations

- Advanced HPMC type adoption

Manufacturers are expanding production capacities, with 14 new facilities announced since Q2 2023.

(redispersible polymer powder types)

FAQS on redispersible polymer powder types

Q: What are the common types of redispersible polymer powder?

A: Common types include vinyl acetate-ethylene (VAE), vinyl acetate versatate (VeoVa), and acrylic-based powders. These are widely used in construction materials for improved adhesion and flexibility. Their selection depends on application requirements and compatibility with other additives.

Q: How do HPMC types influence redispersible polymer powder performance?

A: HPMC (hydroxypropyl methylcellulose) types vary in viscosity and solubility, affecting water retention and workability in mixes. Higher-viscosity HPMC enhances adhesion, while lower grades improve flow. Compatibility with redispersible powders ensures optimal mortar or tile adhesive performance.

Q: Which regions dominate the redispersible polymer powder market share?

A: Asia-Pacific leads due to rapid urbanization and construction growth, followed by Europe and North America. Emerging economies like China and India drive demand. Strict building regulations in developed regions also boost market adoption.

Q: What factors determine the choice of redispersible polymer powder type?

A: Key factors include application (e.g., tile adhesives, EIFS), desired properties (flexibility, water resistance), and substrate compatibility. Cost, local regulations, and environmental standards also influence selection. Manufacturers often customize blends using HPMC for specific needs.

Q: How is the redispersible polymer powder market share evolving with new HPMC innovations?

A: Advanced HPMC types with tailored viscosity profiles enhance redispersible powder efficiency, driving market growth. Eco-friendly formulations and demand for high-performance construction materials further boost adoption. Major players are investing in R&D to capture expanding market segments.

-

Versatile Hpmc Uses in Different Industries

NewsJun.19,2025

-

Redispersible Powder's Role in Enhancing Durability of Construction Products

NewsJun.19,2025

-

Hydroxyethyl Cellulose Applications Driving Green Industrial Processes

NewsJun.19,2025

-

Exploring Different Redispersible Polymer Powder

NewsJun.19,2025

-

Choosing the Right Mortar Bonding Agent

NewsJun.19,2025

-

Applications and Significance of China Hpmc in Modern Industries

NewsJun.19,2025