Jul . 26, 2024 16:23 Back to list

Analyzing HPMC Stock Trends and Future Performance Insights for Investors and Market Enthusiasts

HPMC Stock An Overview of Performance and Market Trends

Hydroxypropyl Methylcellulose (HPMC) is a cellulose ether widely used in various industries, including pharmaceuticals, food, cosmetics, and construction. As the demand for HPMC continues to increase with the growth of these sectors, assessing the stock performance of companies involved in its production offers valuable insights for investors.

Market Demand and Applications

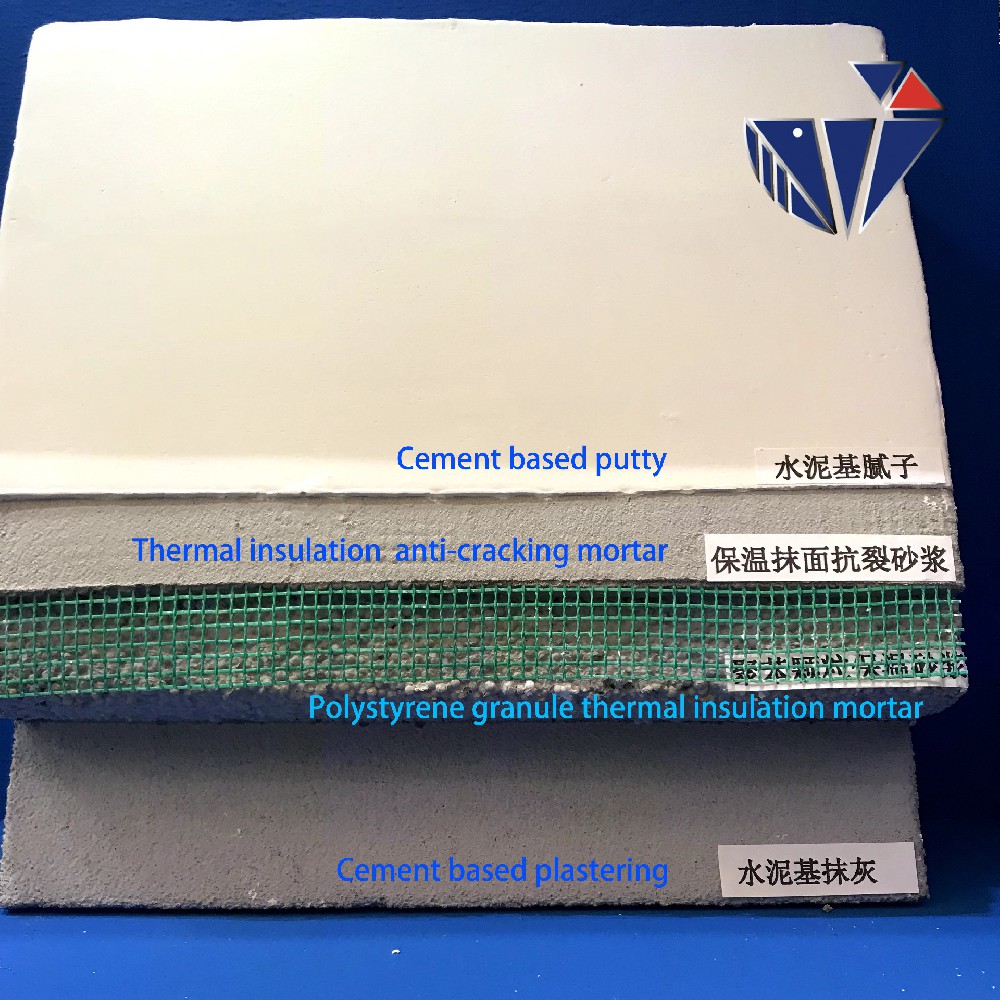

HPMC is known for its excellent binding, thickening, and film-forming properties. In the pharmaceutical industry, it is used as an excipient in drug formulations and controlled-release systems. The food industry utilizes HPMC as a food additive and thickener, while the cosmetics sector employs it in lotions, creams, and hair products. In construction, it serves as a crucial ingredient in tile adhesives and wall putties.

The rising demand for high-quality pharmaceuticals, coupled with the growth of the food and cosmetics industries, positions HPMC as a key player in market dynamics. As consumers increasingly seek natural and sustainable products, the demand for cellulose derivatives is expected to rise, propelling HPMC even further.

Stock Performance

Companies involved in the production of HPMC have shown diverse stock performance patterns reflecting their market strategies, product offerings, and overall operational effectiveness. Investors interested in this niche should consider both established manufacturers and emerging firms that are innovating their product lines.

For instance, significant players in the chemical manufacturing sector, such as Ashland Global Holdings Inc. and Dow Chemical Company, have their stock movements influenced by broader industrial trends and economic factors. These corporations generally benefit from their extensive R&D capabilities, enabling them to introduce new HPMC formulations that cater to specific industry needs.

hpmc stock

On the other hand, smaller firms focused exclusively on HPMC production may exhibit stock volatility based on market conditions, production capacity, and customer contracts. Companies that manage to secure long-term agreements with key clients in construction and pharmaceuticals often see a more stable stock performance as they are able to predict revenue streams more accurately.

Recent Trends and Forecasts

The COVID-19 pandemic has notably impacted industries worldwide, and HPMC is no exception. While many sectors experienced a downturn, the pharmaceutical industry saw a surge, primarily due to an increased focus on healthcare and drug delivery systems. This shift contributed positively to the stock performance of HPMC producers engaged in pharmaceutical applications.

Looking ahead, analysts predict that the market for HPMC will continue to expand. Innovative applications in sustainable packaging and biodegradable products are emerging trends that could further boost the market. Additionally, the global push for eco-friendly products aligns well with HPMC’s biodegradable nature, enhancing its attractiveness among environmentally conscious consumers and industries.

Investment Considerations

When considering investments in HPMC-related stocks, it's important to conduct thorough research into each company's financial health, market position, and growth strategy. Understanding the competitive landscape and potential regulatory changes will also be crucial. Investors should keep an eye on earnings reports, industry developments, and technological advancements, as these factors can significantly influence stock prices.

In conclusion, HPMC has carved a significant niche within various sectors, driving demand and attracting investor interest. While the performance of HPMC stocks can fluctuate based on market dynamics, the overall trend appears positive as diverse industries continue to innovate and expand their applications. By evaluating market conditions and company fundamentals, investors can make informed decisions in this evolving landscape.

-

The Widespread Application of Redispersible Powder in Construction and Building Materials

NewsMay.16,2025

-

The Widespread Application of Hpmc in the Detergent Industry

NewsMay.16,2025

-

The Main Applications of Hydroxyethyl Cellulose in Paints and Coatings

NewsMay.16,2025

-

Mortar Bonding Agent: the Key to Enhancing the Adhesion Between New and Old Mortar Layers and Between Mortar and Different Substrates

NewsMay.16,2025

-

HPMC: Application as a thickener and excipient

NewsMay.16,2025

-

Hec Cellulose Cellulose: Multi functional dispersants and high-efficiency thickeners

NewsMay.16,2025