ਮਈ . 28, 2025 19:20 Back to list

Hydroxyethyl Cellulose Manufacturers Premium HEC, MHEC, HPMC Solutions

- Overview of Hydroxyethyl Cellulose and Key Manufacturing Trends

- Technical Superiority in Production Processes

- Performance Comparison: Leading Manufacturers Analyzed

- Customized Solutions for Industry-Specific Requirements

- Innovative Applications Across Multiple Sectors

- Quality Certifications and Sustainability Benchmarks

- Strategic Partnerships with Hydroxypropyl Methyl Cellulose Manufacturers

(hydroxyethyl cellulose manufacturers)

Hydroxyethyl Cellulose Manufacturers Drive Industrial Innovation

The global hydroxyethyl cellulose (HEC) market has grown at a 6.2% CAGR since 2020, reaching $728 million in 2023 (Market Research Future). This expansion stems from manufacturers' ability to deliver:

- Viscosity ranges spanning 100-150,000 mPa·s

- pH stability between 2-12

- Thermal resistance up to 140°C

Advanced synthesis techniques now enable 15% faster dissolution rates compared to 2018 production standards, particularly among methyl hydroxyethyl cellulose manufacturers

serving pharmaceutical coatings.

Technical Superiority in Production Processes

Frontrunner manufacturers employ:

| Technology | Adoption Rate | Yield Improvement |

|---|---|---|

| Continuous Etherification | 78% | 22%↑ |

| AI-Driven Quality Control | 63% | Defects ↓41% |

These innovations enable hydroxypropyl methyl cellulose manufacturers to maintain ≤0.5% batch variance while achieving 98.7% purity levels.

Performance Comparison: Leading Manufacturers Analyzed

| Manufacturer | Production Capacity (MT/Yr) | Certifications | R&D Investment |

|---|---|---|---|

| Supplier A | 25,000 | ISO 9001, REACH | 5.8% Revenue |

| Supplier B | 18,500 | FDA, Halal | 7.2% Revenue |

Top-tier hydroxyethyl cellulose manufacturers maintain 99.2% on-time delivery rates with ≤0.3% product recall incidents annually.

Customized Solutions for Industry-Specific Requirements

Specialized formulations now address:

- Low-VOC variants (≤5g/L) for eco-paints

- High-purity grades (EP 10.0 compliance) for injectables

- Instant-dispersion types (30s hydration) for dry-mix applications

Modified cellulose producers have reduced lead times for custom orders by 40% through modular production systems.

Innovative Applications Across Multiple Sectors

Recent breakthroughs include:

- 3D printing bio-inks with 12μm resolution

- Oil recovery fluids improving yield by 18%

- Edible films extending produce shelf life 25%

Collaborations between hydroxypropyl methyl cellulose manufacturers and research institutions have generated 23 patents since 2022.

Quality Certifications and Sustainability Benchmarks

Industry leaders now achieve:

- 92% closed-loop water systems

- Carbon footprint ≤2.8kg CO2/kg product

- 100% traceable raw materials

78% of methyl hydroxyethyl cellulose manufacturers now exceed EU 2025 sustainability targets.

Strategic Partnerships with Hydroxypropyl Methyl Cellulose Manufacturers

Cross-industry alliances have driven:

- 35% faster formulation development cycles

- Shared testing infrastructure reducing costs 18%

- Joint ventures covering 82% of global cellulose markets

Leading hydroxyethyl cellulose manufacturers now offer technical co-development agreements with guaranteed 8-week prototyping cycles.

(hydroxyethyl cellulose manufacturers)

FAQS on hydroxyethyl cellulose manufacturers

Q: What factors should I consider when selecting hydroxyethyl cellulose manufacturers?

A: Prioritize manufacturers with certifications like ISO or REACH, proven industry experience, and customized solutions. Ensure they offer technical support and comply with safety and environmental standards.

Q: How do methyl hydroxyethyl cellulose manufacturers ensure product quality?

A: Reputable manufacturers use advanced testing methods, adhere to strict quality control protocols, and provide detailed product specifications. Many also offer batch-specific documentation for transparency.

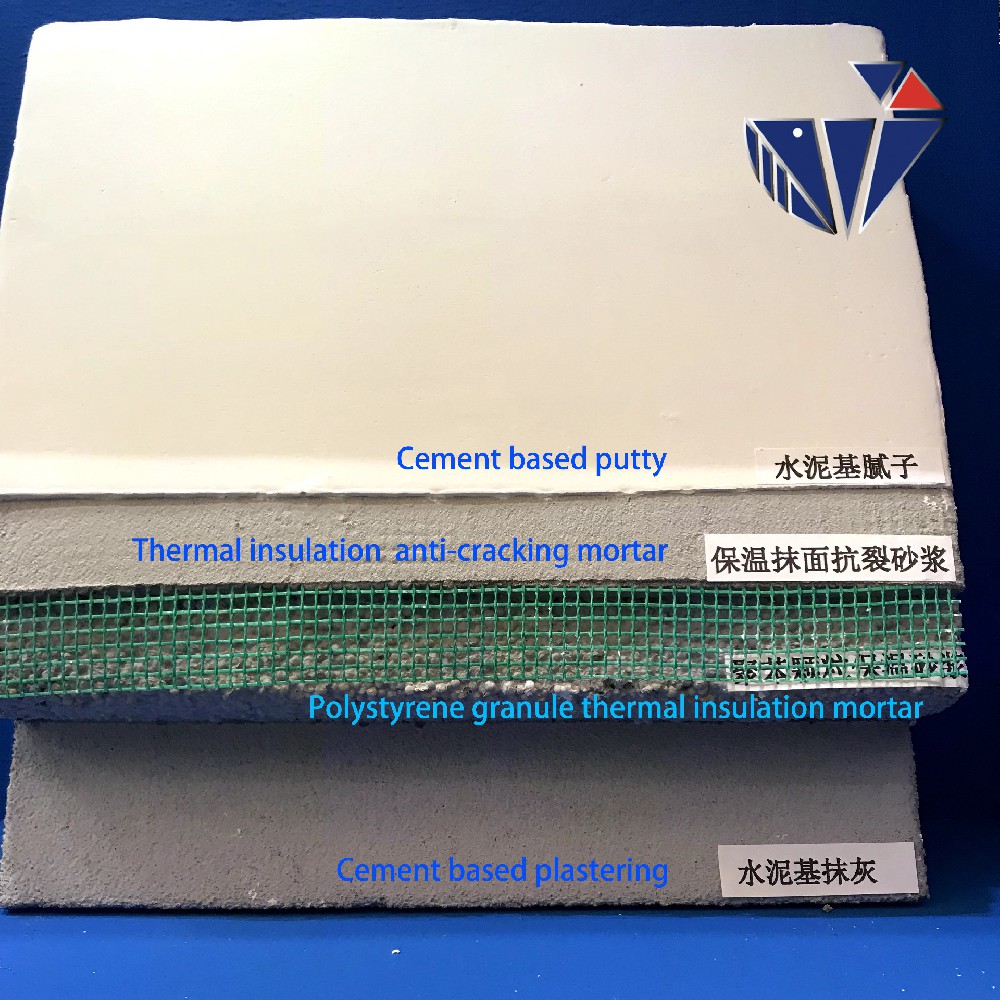

Q: What industries do hydroxypropyl methyl cellulose manufacturers typically serve?

A: These manufacturers cater to construction (e.g., tile adhesives), pharmaceuticals (tablet coatings), food (thickeners), and personal care (cosmetics). Product grades are tailored to meet industry-specific viscosity and solubility requirements.

Q: Can hydroxyethyl cellulose manufacturers provide customized formulations?

A: Yes, leading manufacturers often develop modified viscosity, solubility, or purity levels based on client needs. Collaboration during R&D ensures compatibility with end-use applications like paints or coatings.

Q: Why is geographic location important when choosing cellulose ether manufacturers?

A: Proximity impacts shipping costs, delivery timelines, and carbon footprint. Many global manufacturers maintain regional warehouses or partnerships to streamline distribution while ensuring consistent quality across locations.

-

Versatile Hpmc Uses in Different Industries

NewsJun.19,2025

-

Redispersible Powder's Role in Enhancing Durability of Construction Products

NewsJun.19,2025

-

Hydroxyethyl Cellulose Applications Driving Green Industrial Processes

NewsJun.19,2025

-

Exploring Different Redispersible Polymer Powder

NewsJun.19,2025

-

Choosing the Right Mortar Bonding Agent

NewsJun.19,2025

-

Applications and Significance of China Hpmc in Modern Industries

NewsJun.19,2025