mai . 28, 2025 19:19 Back to list

Redispersible Polymer Powder Market Share, Growth & HPMC Trends 2024

- Overview of the Redispersible Polymer Powder Industry

- Key Drivers Accelerating Market Growth

- Technological Advancements in Production Methods

- Competitive Landscape: Major Suppliers Compared

- Customized Solutions for Diverse Applications

- Real-World Implementation Case Studies

- Future Projections for HPMC and Polymer Powder Markets

(redispersible polymer powder market)

Redispersible Polymer Powder Market Dynamics and Scope

The global redispersible polymer powder market

has demonstrated robust expansion, reaching a valuation of $2.8 billion in 2023 with a 6.9% CAGR projected through 2030. This growth stems from escalating demand in construction materials, particularly in emerging economies where urbanization rates exceed 4% annually. HPMC (hydroxypropyl methylcellulose) derivatives account for 38% of polymer powder formulations, driven by their multifunctional properties in cement-based products.

Growth Catalysts and Industry Challenges

Accelerated infrastructure development across Asia-Pacific nations (notably India and Vietnam) fuels 42% of current demand. Environmental regulations promoting low-VOC construction materials have increased adoption by 27% since 2020. However, fluctuating raw material costs – ethylene vinyl acetate prices varied by ±18% in 2023 – continue challenging manufacturers' profit margins.

Innovations in Polymer Powder Technology

Leading producers have introduced advanced copolymer blends achieving 15-20% improvement in mortar flexibility. Recent breakthroughs include:

- Moisture-resistant formulations maintaining 95% performance in high-humidity environments

- Rapid-setting variants reducing construction timelines by 30%

- Bio-based alternatives comprising 40% renewable content

Vendor Ecosystem Analysis

| Manufacturer | Market Share | Key Product | Regional Strength |

|---|---|---|---|

| Wacker Chemie | 22% | VINNAPAS® 5044N | Europe, North America |

| Celanese | 18% | Dur-O-Set® Elite | Asia-Pacific |

| Shandong Xinlong | 15% | XL-918HPMC | China, ASEAN |

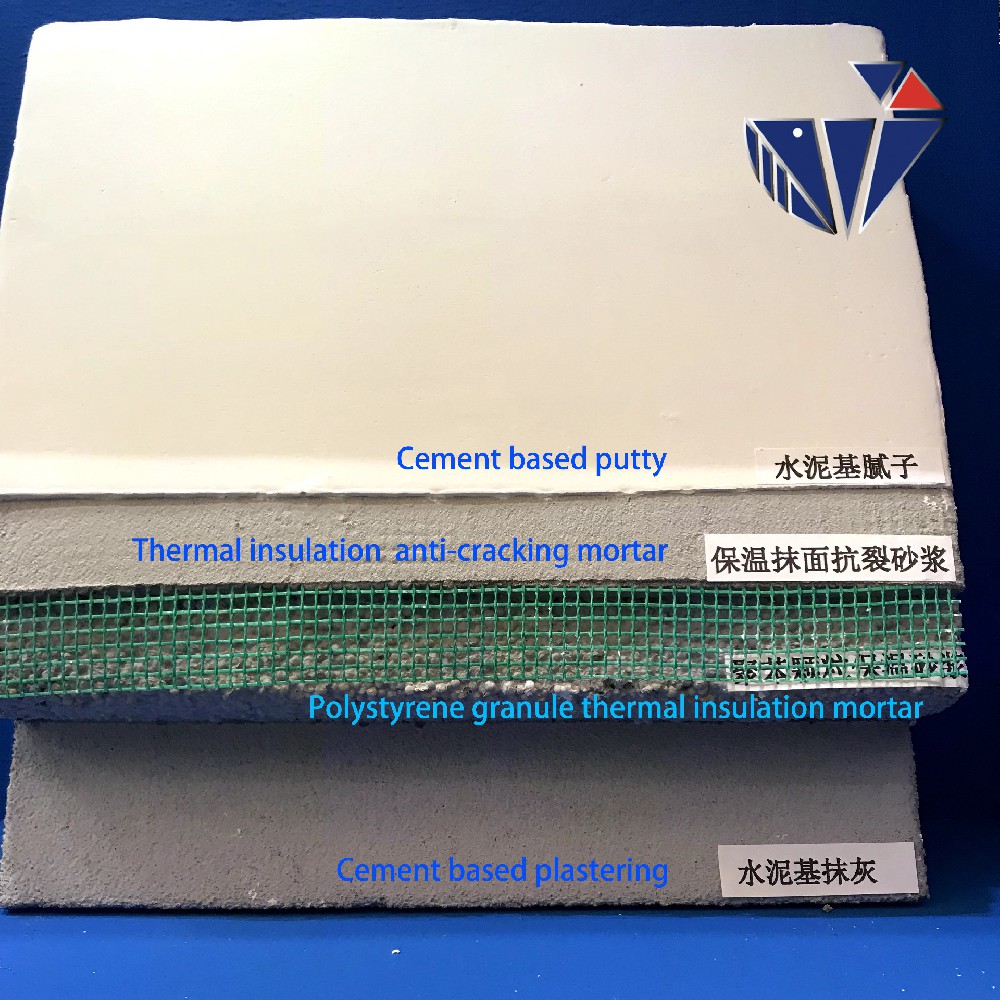

Application-Specific Formulation Strategies

Customization accounts for 34% of premium product sales, with notable configurations including:

- High-flexibility mixes for seismic zones (≥8.0 MPa bond strength)

- Thermal-modified powders for sub-zero applications

- Antimicrobial variants meeting ISO 22196 standards

Operational Efficiency Improvements

A Middle Eastern infrastructure project achieved 19% material savings through optimized polymer-enhanced tile adhesives. European contractors report 40% faster installation times using specialized HPMC formulations in insulation systems.

Redispersible Polymer Powder Market Trajectory Through 2030

Analysts anticipate the HPMC segment capturing 45% of total growth opportunities as green building certifications multiply. Emerging applications in 3D-printed construction materials (projected 29% CAGR) and smart city projects will likely drive 60% of demand increases post-2025. The market's evolution now hinges on balancing performance enhancements with circular economy principles – 78% of industry leaders have committed to 30% recycled content targets by 2027.

(redispersible polymer powder market)

FAQS on redispersible polymer powder market

Q: What are the key drivers of the redispersible polymer powder market growth?

A: The market is driven by rising construction activities, demand for sustainable building materials, and stringent regulations promoting energy-efficient solutions. Growth in the HPMC market also complements this expansion due to its use in polymer formulations.

Q: How is the redispersible polymer powder market share distributed regionally?

A: Asia-Pacific dominates due to rapid urbanization and infrastructure investments, while Europe follows with strong demand for eco-friendly construction materials. The HPMC market’s regional growth patterns align closely with these trends.

Q: What role does HPMC play in the redispersible polymer powder market?

A: HPMC acts as a critical additive, enhancing water retention, workability, and adhesion in polymer powders. Its expanding market directly supports the performance and adoption of redispersible polymer powders in construction applications.

Q: What challenges does the redispersible polymer powder market face?

A: High production costs and fluctuating raw material prices hinder growth. Additionally, competition from alternatives in the HPMC market and regulatory complexities pose challenges for manufacturers.

Q: How are sustainability trends impacting the redispersible polymer powder market?

A: Increasing focus on green construction fuels demand for eco-friendly polymer powders. Innovations in HPMC-based formulations further align the market with sustainability goals, driving adoption in energy-efficient buildings.

-

Versatile Hpmc Uses in Different Industries

NewsJun.19,2025

-

Redispersible Powder's Role in Enhancing Durability of Construction Products

NewsJun.19,2025

-

Hydroxyethyl Cellulose Applications Driving Green Industrial Processes

NewsJun.19,2025

-

Exploring Different Redispersible Polymer Powder

NewsJun.19,2025

-

Choosing the Right Mortar Bonding Agent

NewsJun.19,2025

-

Applications and Significance of China Hpmc in Modern Industries

NewsJun.19,2025