កុម្ភៈ . 15, 2025 05:32 Back to list

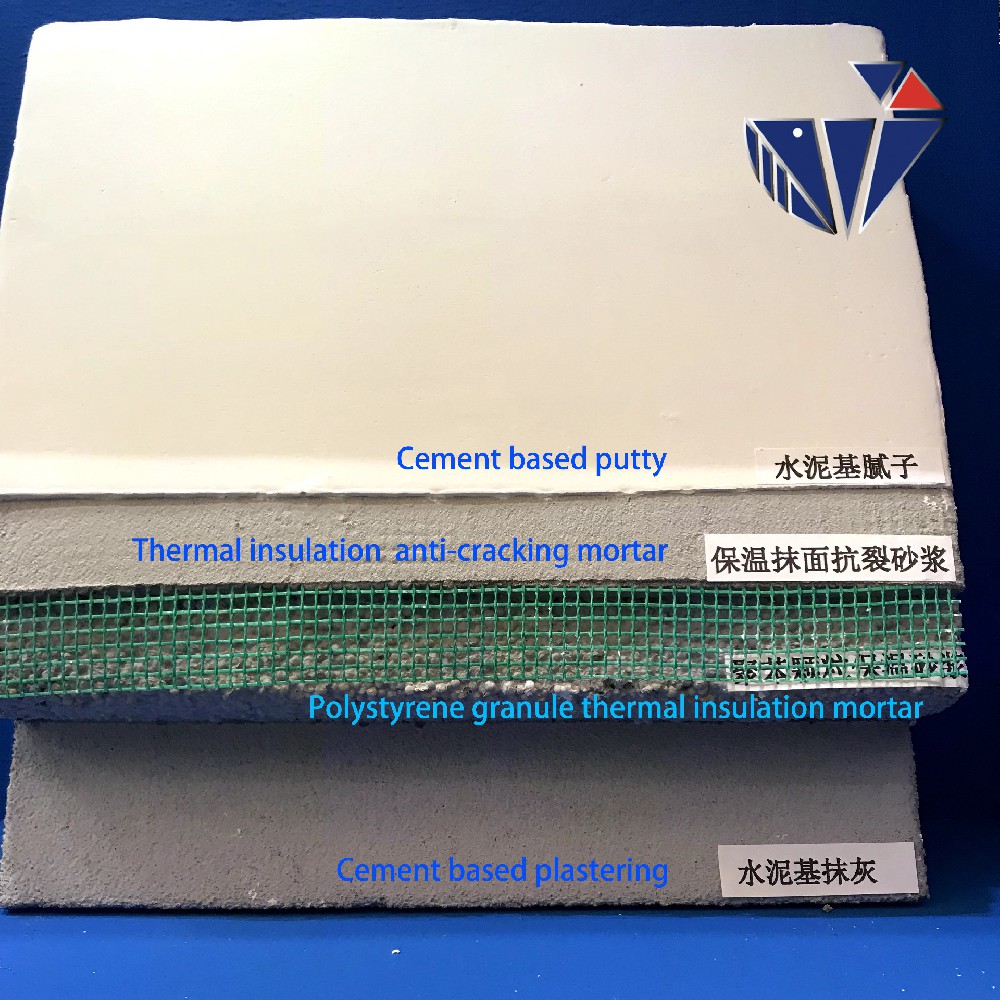

hpmc for tile adhesive

HPMC, which stands for Hydroxypropyl Methylcellulose, is a versatile, specialized polymer primarily used in the pharmaceutical and construction industries. Understanding HPMC's market stock dynamics can provide crucial insights for investors and stakeholders within these sectors. This piece delves into the various dimensions of HPMC as a stock option, focusing on the elements of experience, expertise, authoritativeness, and trustworthiness.

When considering the authoritativeness of HPMC stock as an investment, the reputation and reliability of manufacturers take center stage. Leading companies in this field, known for consistent quality and innovation, often act as industry benchmarks. Their research and development efforts push the boundaries of HPMC applications, which can lead to patents and exclusive products, driving a company's market leadership. An authoritative analysis of HPMC stock would therefore include a review of such companies' market shares, R&D expenditure, and historical financial performance. Furthermore, partnerships with pharmaceutical giants or construction leaders can bolster a company's standing, making its stock more attractive. Trustworthiness in the HPMC stock market is fostered through transparency and ethical practices. Investors tend to favor companies that demonstrate accountability in their environmental impact, supply chain practices, and corporate governance. A company's commitment to sustainable sourcing of raw materials and reducing its carbon footprint can significantly influence investor confidence. Moreover, regulatory compliance and certifications can enhance trust, particularly in industries as sensitive as pharmaceuticals and food. Reliable information sources, such as industry reports, market analyses, and regulatory body publications, are essential for investors seeking trustworthy HPMC stock options. In conclusion, the HPMC stock market embodies a complex interplay of experience, expertise, authoritativeness, and trustworthiness. Investors with a thorough understanding of HPMC's multifaceted applications, coupled with insights into industry trends and company-specific strategies, are better positioned to navigate this nuanced market. By prioritizing sustainable practices and quality assurance, companies can enhance their market appeal and foster long-term investor trust. As industries continue to evolve and place greater emphasis on sustainability and innovation, HPMC's role as a critical material across diverse sectors is poised for further growth, making its stock an intriguing option for discerning investors.

When considering the authoritativeness of HPMC stock as an investment, the reputation and reliability of manufacturers take center stage. Leading companies in this field, known for consistent quality and innovation, often act as industry benchmarks. Their research and development efforts push the boundaries of HPMC applications, which can lead to patents and exclusive products, driving a company's market leadership. An authoritative analysis of HPMC stock would therefore include a review of such companies' market shares, R&D expenditure, and historical financial performance. Furthermore, partnerships with pharmaceutical giants or construction leaders can bolster a company's standing, making its stock more attractive. Trustworthiness in the HPMC stock market is fostered through transparency and ethical practices. Investors tend to favor companies that demonstrate accountability in their environmental impact, supply chain practices, and corporate governance. A company's commitment to sustainable sourcing of raw materials and reducing its carbon footprint can significantly influence investor confidence. Moreover, regulatory compliance and certifications can enhance trust, particularly in industries as sensitive as pharmaceuticals and food. Reliable information sources, such as industry reports, market analyses, and regulatory body publications, are essential for investors seeking trustworthy HPMC stock options. In conclusion, the HPMC stock market embodies a complex interplay of experience, expertise, authoritativeness, and trustworthiness. Investors with a thorough understanding of HPMC's multifaceted applications, coupled with insights into industry trends and company-specific strategies, are better positioned to navigate this nuanced market. By prioritizing sustainable practices and quality assurance, companies can enhance their market appeal and foster long-term investor trust. As industries continue to evolve and place greater emphasis on sustainability and innovation, HPMC's role as a critical material across diverse sectors is poised for further growth, making its stock an intriguing option for discerning investors.

Next:

Latest news

-

Why HPMC is a Key Additive in Wall Putty Formulations

NewsAug.05,2025

-

Redispersible Powder in Decorative Renders: Function Meets Finish

NewsAug.05,2025

-

Redispersible Powder for Interior Wall Putty: Smooth Results Every Time

NewsAug.05,2025

-

HPMC’s Water Retention Capacity in Dry Mortar Applications

NewsAug.05,2025

-

HPMC Factory Contributions to Liquid Detergents

NewsAug.05,2025

-

How HPMC Factory Products Change Detergent Textures

NewsAug.05,2025

Related PRODUCTS