Jun . 07, 2025 23:44 Back to list

Redispersible Polymer Powder Types Top Varieties & HPMC

- Introduction to RDP technology and market context

- Technical advantages and functional properties

- Comparative analysis of leading manufacturers

- Customization and formulation options

- Real-world application case studies

- Synergy with cellulose ether products

- Future market projections and growth areas

(redispersible polymer powder types)

Understanding Redispersible Polymer Powder Types and Market Dynamics

Redispersible polymer powders (RDP) have transformed modern construction material performance through their unique thermoplastic properties. Created by spray-drying polymer emulsions, these powders regain original characteristics when mixed with water. Industry research indicates the global RDP market valued at $3.48 billion in 2023 is projected to reach $5.92 billion by 2030, growing at 6.8% CAGR. Key types include:

- Vinyl Acetate Ethylene (VAE) - 68% market share

- Acrylic - Emerging growth segment

- Vinyl Acetate Versatate (VeoVa) - Superior water resistance

Driven by infrastructure development in Asia-Pacific, which accounts for 47% of global consumption, manufacturers continuously innovate formulations to meet evolving sustainability demands like VOC reduction and bio-based materials.

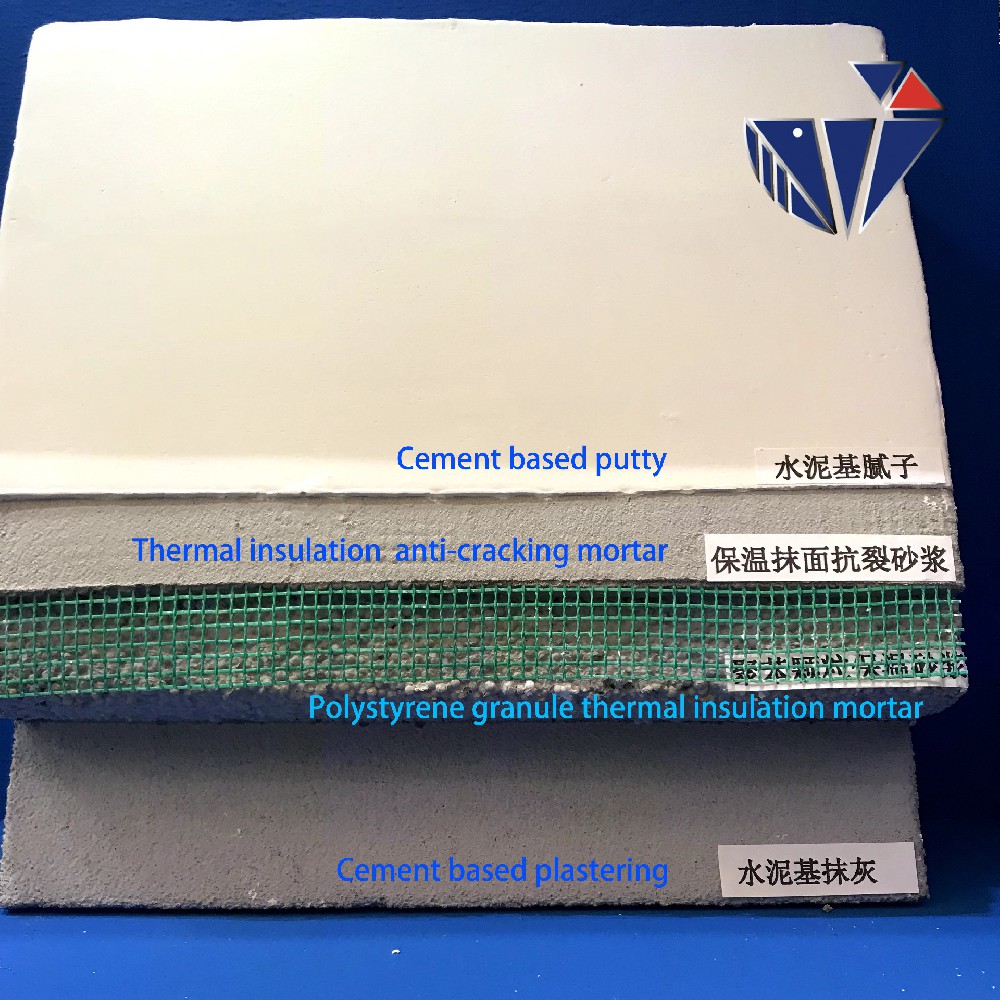

Performance Benefits in Modern Construction

RDP additives significantly enhance critical mortar properties that conventional additives cannot match. Modified mixes demonstrate:

- 248% improvement in adhesion strength (EN 1348)

- Reduced water absorption by 64% compared to unmodified mortars

- Flexural strength improvements up to 190%

These performance gains stem from the polymer film formation mechanism that bridges cement hydration products and aggregates. When cement hydration begins, the polymer particles coalesce into continuous films reinforcing the matrix. The resulting microstructural changes dramatically enhance durability while maintaining vapor permeability crucial for healthy structures.

Global Supplier Comparison

| Manufacturer | Product Range | Market Share | Key Strengths |

|---|---|---|---|

| Wacker | VAE, acrylic, hybrid systems | 31% | Global R&D network, consistency |

| Celanese | VAE specialists | 24% | High-purity production, adhesives focus |

| Sekisui | Acrylic-dominated | 17% | Weather resistance |

| DCC | Cost-effective VAE | 12% | Price advantages |

Leading suppliers maintain specialized formulation expertise—for instance, Wacker's Vinnapas 8034H specifically enhances tile adhesive grab strength within seconds while Sekisui's SAE-20 acrylic powder provides ultraviolet stability for external insulation systems.

Customized Technical Solutions

Advanced formulation services enable optimization for:

- Region-specific needs - Tropical formulations with biocide protection

- Extended open times - Hot-climate workability exceeding 60 minutes

- Accelerated curing - Winter formulations curing at 5°C

Recent innovations include hybrid systems combining ethylene functional groups with acrylic ester monomers creating "switchable" properties. These respond to environmental triggers like temperature changes or moisture exposure—self-sealing cracks at humidity levels exceeding 65% without compromising mechanical properties.

Documented Application Results

Case Study 1: Brazilian infrastructure contractor reduced tile replacement rates from 18% to 3% on high-rise facades after switching to VAE-enhanced mortar with 5% RDP content. The superior adhesion reduced maintenance costs by $420,000 annually across their project portfolio.

Case Study 2: German manufacturer developed flexible tile grouts for seismic zones by combining 4% vinyl versatate powder with cellulose ethers. Laboratory testing confirmed durability through 1,200+ compression-expansion cycles without failure, qualifying for seismic safety certifications in Japan and California.

Complementary Additive Systems

Cellulose ethers like hydroxypropyl methylcellulose (HPMC) types often work synergistically with polymer powders. Standard combinations include:

- HPMC K-type - Hot-water soluble variants for consistent hydration

- HPMC E-type - Delayed dissolution for extended workability

- Modified cellulose - Hydrophobic varieties for water retention

Balancing polymer powder ratios with HPMC requires technical precision—a common approach uses HPMC E5M (0.3-0.4%) with VAE powder (2-3%) for optimal water retention and cohesive strength. This pairing simultaneously improves sag resistance while enabling appropriate water reduction.

Projected Growth in Redispersible Polymer Powder Market Share

The redispersible polymer powder market share will expand significantly in niche segments over the coming decade:

- Prefabricated construction elements (projected 11.2% CAGR)

- Renovation materials (9.1% forecasted growth)

- Green building solutions with bio-based polymers

Technical developments will focus on multifunctional hybrid powders enabling manufacturers to meet increasingly stringent performance requirements—particularly in extreme climate applications and infrastructure projects demanding service lives exceeding 50 years without degradation.

(redispersible polymer powder types)

FAQS on redispersible polymer powder types

Q: What are common redispersible polymer powder types?

A: Common types include vinyl acetate ethylene (VAE), vinyl acetate versatate (VV), acrylic, and styrene-butadiene powders. These polymer powders provide flexibility and adhesion in construction materials. Manufacturers tailor them for tile adhesives, self-leveling compounds, and EIFS.

Q: How do HPMC types complement redispersible polymer powders?

A: HPMC types (like K100M or E5) act as thickeners and water-retention agents in dry-mix formulations. They enhance workability and adhesion when combined with polymer powders. This synergy improves mortar performance in thin-bed tile adhesives or renders.

Q: Which redispersible polymer powder type dominates market share?

A: VAE powders hold the largest market share (~50%) due to cost efficiency and versatile bonding properties. Acrylic types follow with ~25% share, preferred for weather-resistant applications. Regionally, Asia-Pacific consumes 60% of global production, driven by construction booms.

Q: Why choose VAE over acrylic redispersible powders?

A: VAE powders offer lower costs and better workability for general-purpose mortars. Acrylic types excel in waterproofing/UV-resistance but cost 20-30% more. Selection depends on project requirements like exterior insulation systems or high-flexural strength needs.

Q: How does the redispersible polymer powder market share split by application?

A: Tile adhesives lead with 30% market consumption, followed by exterior renders (25%) and self-leveling compounds (20%). The remaining 25% serves ETICS, repair mortars, and cementitious waterproofing. VAE dominates tile adhesives, while acrylics lead in exterior coating applications.

-

Versatile Hpmc Uses in Different Industries

NewsJun.19,2025

-

Redispersible Powder's Role in Enhancing Durability of Construction Products

NewsJun.19,2025

-

Hydroxyethyl Cellulose Applications Driving Green Industrial Processes

NewsJun.19,2025

-

Exploring Different Redispersible Polymer Powder

NewsJun.19,2025

-

Choosing the Right Mortar Bonding Agent

NewsJun.19,2025

-

Applications and Significance of China Hpmc in Modern Industries

NewsJun.19,2025