ડીસેમ્બર . 01, 2024 22:28 Back to list

hpmc stock

HPMC Stock An Insight into Investment Opportunities

In recent years, the investment landscape has witnessed a burgeoning interest in companies specializing in hydroxypropyl methylcellulose (HPMC). As a versatile polymer, HPMC serves various industries, particularly in pharmaceuticals, food, and construction. With the ongoing developments in these sectors, understanding HPMC stock could yield profitable investment opportunities for savvy investors.

What is HPMC?

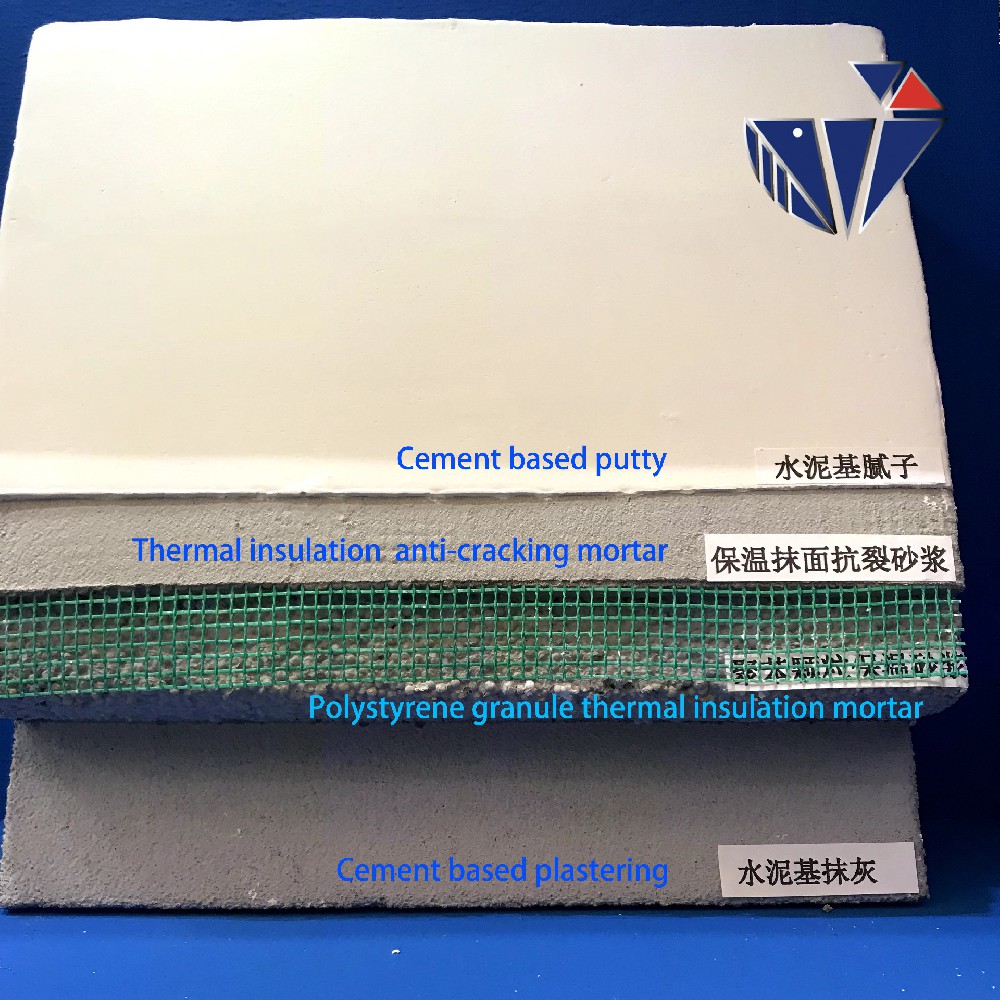

Hydroxypropyl methylcellulose is a non-ionic, water-soluble polymer primarily derived from cellulose. Its unique properties, such as high viscosity, thermal stability, and film-forming ability, make it an indispensable ingredient in many formulations. In the pharmaceutical industry, HPMC is used as a binding agent in tablets and as a controlled-release agent for drug formulations. The food industry utilizes HPMC as a thickener, emulsifier, and stabilizer, while the construction sector benefits from its ability to improve the workability and adhesion of mortars and pastes.

Market Demand and Growth Potential

The increasing demand for HPMC across various applications is a major driver of its market growth. The pharmaceutical sector, in particular, has experienced a significant uptick due to the ongoing development of new drug formulations and the increasing prevalence of chronic diseases requiring long-term medication. Moreover, the global food industry continues to expand, driven by rising consumer demand for processed and functional foods, boosting the need for HPMC as a food additive.

Furthermore, as urbanization accelerates and infrastructure projects proliferate worldwide, the construction industry is also expected to play a pivotal role in driving HPMC's demand. Enhanced properties of construction materials, such as improved water retention and workability, position HPMC as a valuable additive in modern building practices.

Analyzing HPMC Stocks

hpmc stock

Investors looking into HPMC stocks should consider several factors that can influence their performance. First, it is essential to assess the financial health of companies involved in the production and distribution of HPMC. Key financial ratios, trends in revenue growth, and profitability margins provide insights into a company's operational efficiency and market competitiveness.

Another critical factor to examine is the broader market trend for industries utilizing HPMC. For instance, understanding shifts in pharmaceutical regulations, food safety standards, and construction regulations can affect demand. Companies that adapt promptly to these changes are likely to fare better in the stock market.

Additionally, technological advancements in HPMC production and application can also influence stock performance. Firms that innovate and improve production efficiency or develop new HPMC applications are often positioned to capture more market share.

Risks and Considerations

Despite the potential for growth, investing in HPMC stocks does come with inherent risks. Market volatility, regulatory changes, and competition among manufacturers can impact stock performance. Investors should also be wary of external economic factors such as inflation, commodity prices, and global supply chain dynamics that can affect overall industry profitability.

Moreover, environmental concerns and sustainability issues are becoming crucial in the investment decision-making process. Companies that prioritize eco-friendly production methods and sustainable sourcing of raw materials may attract socially conscious investors, potentially driving stock values higher in a competitive landscape.

Conclusion

HPMC stocks present a compelling opportunity for investors looking to capitalize on the growth of diverse industries. With a solid understanding of HPMC's applications, market trends, and the financial health of key players, investors can make informed decisions. However, it's essential to remain cognizant of potential risks and industry dynamics that may affect the market. As demand for HPMC continues to rise, the stocks associated with this versatile polymer may well prove to be a worthwhile addition to an investment portfolio. Through thorough research and strategic planning, investors can navigate the complexities of HPMC stocks and potentially reap significant rewards in the coming years.

-

Unlocking the Benefits of HPMC Products: A Gateway to Versatile Applications

NewsAug.07,2025

-

Unleashing the Potential of HPMC Ashland: A Comprehensive Look

NewsAug.07,2025

-

Tile Bonding Cellulose: The Key to Superior Adhesion and Durability

NewsAug.07,2025

-

Hydroxypropyl Methylcellulose Powder: The Versatile Component in Modern Pharmaceuticals

NewsAug.07,2025

-

Hydroxyethyl Cellulose: The Versatile Solution for Various Industries

NewsAug.07,2025

-

Hydroxyethyl Cellulose (HEC): The Versatile Polymer for Various Applications

NewsAug.07,2025