Dub . 28, 2025 01:17 Back to list

Competitive Redispersible Polymer Powder Price & Market Insights

- Current Market Dynamics for Redispersible Polymer Powder

- Technical Superiority Driving Price Competitiveness

- Manufacturer Landscape: Capability Comparison

- Custom Formulation Strategies for Diverse Applications

- Performance Metrics Across Industrial Use Cases

- Regional Cost Variations and Procurement Insights

- Future Projections: Balancing Price and Innovation

(redispersible polymer powder price)

Understanding the Redispersible Polymer Powder Price Landscape

The global market for redispersible polymer powder witnessed a 6.8% CAGR growth from 2019 to 2023, with pricing fluctuations directly tied to vinyl acetate ethylene (VAE) raw material costs. Current bulk pricing in China ranges from $1,850-$2,400/MT FOB, while European suppliers quote $2,600-$3,100/MT CIF. Three primary factors influence these figures:

- Acetic acid feedstock volatility (14% price swing Q1-Q3 2024)

- Energy consumption rates (2.8-3.4 kWh/kg production efficiency)

- Logistics bottlenecks affecting Asian exports

Technical Parameters Impacting Market Position

Leading manufacturers differentiate through advanced polymerization techniques:

| Parameter | Standard Grade | Premium Grade | Custom Solutions |

|---|---|---|---|

| Min Film Temp | 5°C | -3°C | Adjustable (-8°C to +10°C) |

| Ash Content | 12%±2 | 8%±1 | Controlled 5-15% |

| Reactivity Window | 30-45 mins | 60-90 mins | Programmable 15-120 mins |

Competitive Analysis of Major Producers

| Manufacturer | Capacity (kT/yr) | Price Index | Key Markets |

|---|---|---|---|

| Shandong Huiguang | 180 | 0.92 | Asia-Pacific (63%) |

| Wacker Chemie | 220 | 1.15 | Europe/NA (78%) |

| Celanese Corp | 150 | 1.08 | Global Distribution |

Customization Strategies for Specific Applications

Modified RDP formulations now account for 38% of premium market revenue:

- Cold Weather Mortars: Alkyl ketene dimer-modified powders

- High-flex Tiles: Hybrid acrylate-VAE systems

- Rapid-setting Compounds: Nano-silica accelerated variants

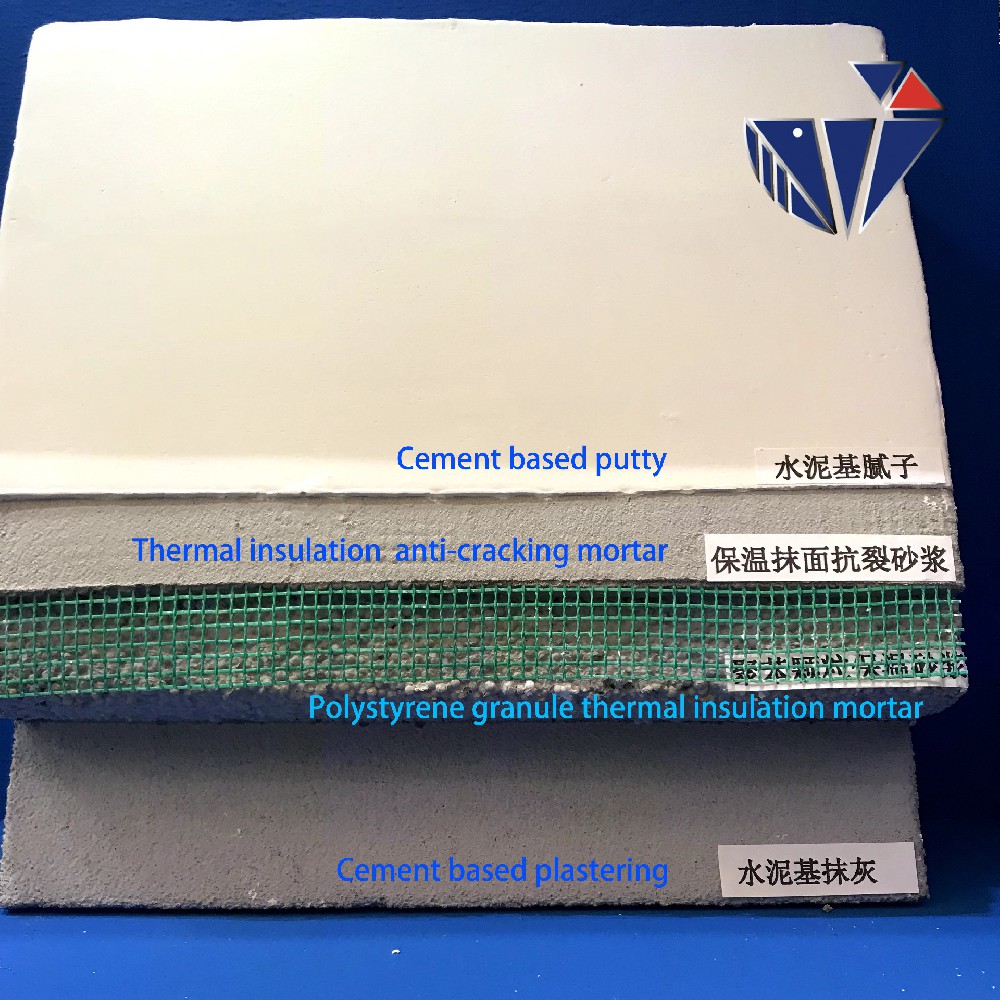

Documented Performance in Construction Projects

| Project Type | RDP Usage (kg/m³) | Cost Impact | Durability Gain |

|---|---|---|---|

| External Wall Insulation | 18-22 | +9% material cost | 34% crack reduction |

| Self-leveling Flooring | 25-30 | +15% formulation | 28% faster cure |

Geopolitical Influences on Regional Pricing

Recent trade patterns reveal:

- Chinese export tariffs: 6.5% → 8.2% (2024 Q2)

- EU anti-dumping duties: 12-18% on select Asian imports

- North American rail freight surcharges: +$28-45/MT

Strategic Outlook for Redispersible Polymer Powder Economics

With the redispersible polymer powder market share projected to reach $4.1B by 2028, manufacturers must balance production costs against emerging technical requirements. Chinese producers are investing $120M in advanced reactor systems to reduce energy intensity by 19%, potentially resetting global redispersible polymer powder price

benchmarks. The challenge lies in maintaining profit margins (current average: 22-28%) while meeting evolving performance specifications across construction, automotive, and specialty adhesive sectors.

(redispersible polymer powder price)

FAQS on redispersible polymer powder price

Q: What factors influence the current redispersible polymer powder price?

A: The price is influenced by raw material costs (e.g., vinyl acetate ethylene), energy prices, supply-demand dynamics, and regional market conditions. Environmental regulations and production capacity also play a role. Market competition in regions like China further impacts pricing trends.

Q: How is the global redispersible polymer powder market share distributed?

A: The market share is dominated by key players in Asia-Pacific, particularly China, due to high construction activity. Europe and North America follow, driven by demand for sustainable building materials. Emerging economies are gaining traction due to infrastructure development.

Q: What drives redispersible polymer powder demand in China?

A: China's demand is fueled by rapid urbanization, growth in construction projects, and government infrastructure investments. Strict environmental policies also push adoption of high-quality, eco-friendly additives. Local production capacity expansion further supports market dominance.

Q: How do raw material costs affect redispersible polymer powder market trends?

A: Fluctuations in petrochemical prices directly impact production costs, influencing final product pricing. Volatility in ethylene or vinyl acetate markets can disrupt supply chains. Manufacturers often adjust pricing strategies to mitigate these risks.

Q: What challenges do Chinese redispersible polymer powder manufacturers face?

A: Key challenges include rising raw material costs, stringent environmental regulations, and international competition. Trade policies and tariffs also affect export competitiveness. Innovations in cost-effective production methods are critical to sustaining growth.

-

Versatile Hpmc Uses in Different Industries

NewsJun.19,2025

-

Redispersible Powder's Role in Enhancing Durability of Construction Products

NewsJun.19,2025

-

Hydroxyethyl Cellulose Applications Driving Green Industrial Processes

NewsJun.19,2025

-

Exploring Different Redispersible Polymer Powder

NewsJun.19,2025

-

Choosing the Right Mortar Bonding Agent

NewsJun.19,2025

-

Applications and Significance of China Hpmc in Modern Industries

NewsJun.19,2025