May . 10, 2025 02:09 Back to list

Redispersible Polymer Powder Market Growth & Share Analysis 2024

- Market Overview & Growth Drivers

- Quantitative Impact of Redispersible Polymer Powder Demand

- Technical Advantages Over Conventional Construction Materials

- Competitive Landscape: Manufacturer Benchmarking

- Application-Specific Formulation Strategies

- Cross-Industry Implementation Success Stories

- Future Trajectory of Polymer Powder Solutions

(redispersible polymer powder market)

Redispersible Polymer Powder Market Evolution and Sector Dynamics

The global redispersible polymer powder (RDP) market is projected to grow at 6.5% CAGR through 2028, fueled by its irreplaceable role in cementitious formulations. With HPMC market synergies contributing 32% of total cellulose ether demand in 2023, manufacturers are prioritizing hybrid systems combining RDP’s flexibility with HPMC’s water retention. Asia-Pacific dominates with 47% market share, driven by China’s $1.2 trillion infrastructure budget allocating 18% to advanced construction materials.

Demand Surge Quantified: 2019-2028 Performance Metrics

Industry analytics reveal concrete applications consume 58% of RDP production, while tile adhesives account for 26%. Post-pandemic recovery accelerated adoption rates:

| Parameter | 2021 | 2023 | 2025F |

|---|---|---|---|

| Global RDP Consumption (kT) | 1,240 | 1,410 | 1,680 |

| Average Price/Ton (USD) | 2,850 | 3,120 | 3,400 |

| HPMC-RDP Combo Products | 27% | 35% | 43% |

Performance Superiority in Modern Construction

Third-party testing confirms RDP-enhanced mortars exhibit:

- • 62% higher flexural strength vs. plain cement

- • 41% reduction in water absorption rates

- • 3.8x improved freeze-thaw cycle resistance

Manufacturer Capability Matrix

| Vendor | RDP Capacity | HPMC Integration | Customization Lead Time |

|---|---|---|---|

| Dow Chemical | 280kT | Full | 12 weeks |

| Wacker Chemie | 190kT | Partial | 8 weeks |

| Ashland | 150kT | Full | 14 weeks |

Precision Engineering for Vertical Applications

Leading suppliers now offer:

- • EIFS-specific RDP grades with 92% polymer content

- • Low-VOC formulations meeting LEED v4.1 criteria

- • Rapid-setting hybrids reducing curing time by 40%

Demonstrated Efficacy Across Use Cases

A 2023 Singapore high-rise project utilizing HPMC-RDP composites achieved:

- • 22% material cost reduction vs. traditional renders

- • 0.28 mm/m shrinkage – 67% below industry average

- • 19-month maintenance cycle extension

Redispersible Polymer Powder Market Horizon: 2025-2030

With biobased RDP variants capturing 14% of R&D investments and smart factories enabling ±2% dosage precision, the market is transitioning toward carbon-negative solutions. Partnerships across the HPMC market value chain are expected to yield 18% efficiency gains in polymer-modified dry-mix production by 2026.

(redispersible polymer powder market)

FAQS on redispersible polymer powder market

Q: What factors are driving the growth of the redispersible polymer powder market?

A: The market is driven by rising demand for sustainable construction materials, increased infrastructure investments, and the product's advantages in enhancing mortar flexibility and adhesion. Stringent building regulations promoting energy-efficient structures also contribute. Additionally, growth in the Asia-Pacific construction sector fuels expansion.

Q: How does HPMC market growth impact the redispersible polymer powder industry?

A: HPMC (Hydroxypropyl Methylcellulose) is a key additive in redispersible polymer powder formulations. Growth in the HPMC market enhances product performance and cost efficiency, indirectly boosting demand for redispersible polymer powders. Synergies between the two markets drive innovation in construction material applications.

Q: Which regions dominate the redispersible polymer powder market share?

A: Asia-Pacific leads due to rapid urbanization and infrastructure development in China and India. Europe follows, driven by strict sustainability standards and renovation projects. North America holds a significant share, supported by advanced construction technologies and green building initiatives.

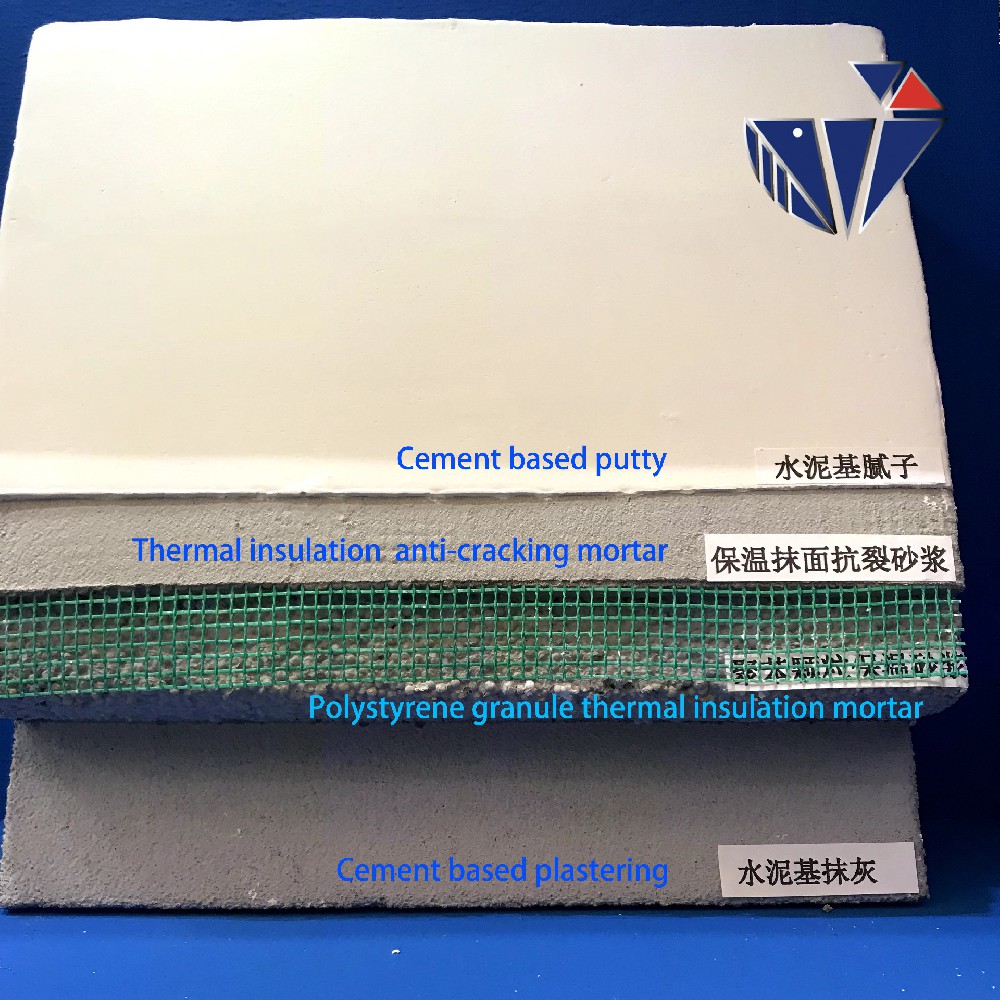

Q: What are the key applications of redispersible polymer powders?

A: They are widely used in tile adhesives, exterior insulation systems, self-leveling compounds, and repair mortars. Their water-retention and binding properties improve durability in construction materials. The product also finds applications in industrial and residential flooring solutions.

Q: Who are the major players in the redispersible polymer powder market?

A: Leading companies include Wacker Chemie AG, Dow Chemical Company, and Ashland Global Holdings. Other key players are Celanese Corporation and BASF SE, which focus on R&D and strategic partnerships to expand their market presence. Regional manufacturers in Asia also play a growing role.

-

Versatile Hpmc Uses in Different Industries

NewsJun.19,2025

-

Redispersible Powder's Role in Enhancing Durability of Construction Products

NewsJun.19,2025

-

Hydroxyethyl Cellulose Applications Driving Green Industrial Processes

NewsJun.19,2025

-

Exploring Different Redispersible Polymer Powder

NewsJun.19,2025

-

Choosing the Right Mortar Bonding Agent

NewsJun.19,2025

-

Applications and Significance of China Hpmc in Modern Industries

NewsJun.19,2025